El robo de identidad es un delito, que ocurre cuando una persona utiliza la información personal de otra para cometer un fraude, de ahí la importancia de proteger el número de seguro social o número de la tarjeta de crédito, claves de acceso o cualquier información relacionada a su nombre personal.

¿Qué sucede cuando ha sido victima de robo de identidad?

-

- Hacen compras con su tarjeta de crédito o débito.

-

- Pueden alquilar inmuebles a su nombre.

-

- Pueden abrir cuentas a su nombre.

-

- Pueden solicitar créditos por altas sumas de dinero bajo su nombre.

-

- Alguien más puede recibir un tratamiento médico que estaba destinado para usted.

Es común que la victima se entere que su identidad ha sido robada cuando es demasiado tarde, frecuentemente, recibe una llamada de un cobrador por una deuda que desconoce o simplemente por un reporte crediticio negativo.

Los robos de identidad han crecido de una forma acelerada, con frecuencia se comenten fraudes a través de nuevas estrategias que están usando los delincuentes para hurtar los datos personales. Estos fraudes traen como consecuencia el daño del buen nombre, del historial crediticio, la pérdida de tiempo al tratar de solucionar los daños y hasta altas sumas de dinero.

Una de las consecuencias de la pandemia fue el incremento de robos de identidad, la Comisión Federal de Comercio de los Estados Unidos recibió 1.4 millones de denuncias por robo de identidad en año 2020.

¿Cuáles son los medios más comunes que usan los delincuentes para robar su identidad?

Con frecuencia surgen nuevas tendencias gracias a la agilidad de los delincuentes que conocen a profundidad las debilidades, estas son algunas de las más omunes:

-

- Filtración de datos: Ocurre cuando se filtra información confidencial (personal o financiera) desde una locación segura a un entorno no confiable. Puede ocurrir que los datos sean robados desde su computadora personal o a una compañía que tenga su información personal.

-

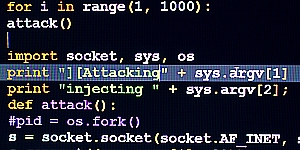

- Programa malicioso o “malware”: Es un software peligroso diseñado para dañar computadoras y sistemas informáticos.

-

- “Phishing” o “spoofing”: Es cuando hacen envíos de correos electrónicos falsos, mensajes de texto o crean un sitio web de imitación para intentar robar su información personal o su identidad con el único objetivo de robar sus números de tarjetas de crédito, de cuentas bancarias, pines de tarjetas de débito y contraseñas.

-

- Fraude en subastas por internet: Implica la tergiversación de un producto anunciado en un sitio de subastas por Internet o la no entrega de mercancía.

-

- Llamadas telefónicas: Se hacen pasar por entidades para robar su identidad a través de engaños e información falsa.

Son innumerables los métodos que usan los delincuentes para robar la identidad, incluso los ciberdelincuentes también utilizaron el robo de identidad como un medio para obtener acceso a los pagos de estímulo federal emitidos por el Servicio de Impuestos Internos de los Estados Unidos (IRS, por sus siglas en inglés) y que son elegibles para los residentes de Estados Unidos. Estos casos fueron denunciados a la FTC como incidentes de robo de identidad fiscal. La cantidad de denuncias en 2020 triplicaron en comparación con las de 2019, con la FTC recibiendo 89.390 reportes en 2020 y 27.450 el año anterior.